If you've discovered that the house you’re looking to buy has been underpinned or requires underpinning, you may wonder what effect this will have on getting a mortgage. Can you even get a mortgage on an underpinned house? Subsidence and underpinning can influence how lenders view a property even if the subsidence is resolved. But it doesn't necessarily have to mean the end of your house buying dreams. Many lenders will consider underpinned properties for mortgages as long as you meet certain criteria.

In this article, we'll look at underpinned property mortgages, including what they are, how they vary from standard mortgages and what you need to look out for when buying an underpinned property.

The Topics Covered in this Article Are Listed Below:

What Does Underpinning Mean?

Underpinning strengthens a building's foundations to make it more secure. The process is commonly used when a building has subsidence when the ground underneath a building moves or sinks. Underpinning is a way to repair the foundations and support the building.

Underpinning may be necessary for various reasons, including:

- Foundation failure or settlement

- Changes in soil conditions

- Structural modifications or additions to the building

- Damage caused by nearby construction or excavation

Overall, underpinning is a critical construction technique used to strengthen and stabilize foundations, ensuring the long-term stability and safety of buildings and structures. It requires careful planning, engineering expertise, and precise execution to achieve effective results.

Why is Underpinning Required?

The soil moving within a building's foundations affects the structure's support. Once this support is weakened, the building may move and become unsafe. Underpinning is used to strengthen the structure. Underpinning may also be used to provide support if another storey is added as an extension to ensure the additional weight is supported. The most common types of houses that require underpinning are period properties which have old foundations.

What are the signs that a Property Needs Underpinning?

Depending on the severity of the subsidence, some tell-tale signs that your house may need underpinning include small cracks appearing in walls and around doorframes and windows. Other signs to look out for include:

- Gaps in between window frames, doors and even bricks

- Stuck windows and doors that you cannot close

- Sloping floors

While old mining land, flooding, trees and poor ground condition can cause subsidence, not all structural damage is due to subsidence. It can also be caused by:

- The weight of the building causing soil compression, known as settlement

- Landslip or the downward movement of sloping ground

- Expansion of the soil

What are the Different Methods of Underpinning?

Several different underpinning methods are used to support a property experiencing structural or subsidence problems.

Soil Strengthening

Also called soil stabilisation, this process is used if the soil under the foundations is weak or has been removed. It involves injecting a structural resin into the ground to replace the eroded soil.

Mass Concrete

Pits are dug under the foundations and filled with concrete to create an additional layer of foundation underneath the existing foundations.

Beam and Base

Like the mass concrete process, beam and base involve a concrete beam placed under the existing footing that will distribute the weight of the building.

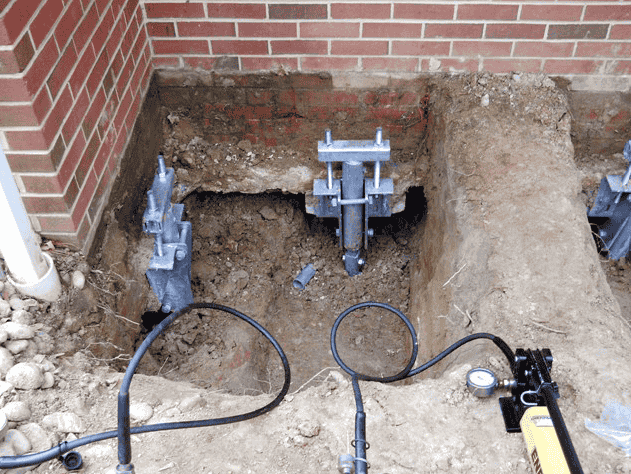

Screw Piles and Brackets

Screw piles and brackets are often used when more traditional types of underpinning aren't suitable. The process involves digging a trench around the affected area and inserting screw piles deep into the ground to act as anchor points. Support brackets are then attached to the screw piles under the foundations to lift the building back into a level position.

Some contractors provide a guarantee for underpinning work, which usually covers a certain time period, normally several years. However, in most cases, underpinning guarantees will only cover the original cause of the subsidence and the underpinning, not any future issues that may arise.

How Much Does Underpinning Cost?

The cost of underpinning can vary significantly depending on various factors, including the size and complexity of the project, the condition of the existing foundation, the accessibility of the site, and the specific underpinning method used. Additionally, factors such as labour costs, materials, equipment rental, permits, and any necessary engineering or design services will also contribute to the overall cost.

As a rough estimate, underpinning costs can range from £5,000 to £30,000 or more for a typical residential property in the UK. However, it's important to note that this is just a general range, and the actual cost could be higher or lower depending on the specific circumstances of the project. There may also be additional costs to consider, such as replacing timbers and bricks that have been damaged subsidence or internal decorating costs.

For more accurate pricing, it's recommended to obtain quotes from multiple reputable contractors or underpinning specialists. They can assess the site, evaluate the extent of the underpinning work required, and provide a detailed cost estimate based on the specific needs of the project.

Additionally, it's essential to budget for any additional expenses that may arise during the underpinning process, such as unforeseen structural issues, permit fees, or post-construction repairs and restoration.

Overall, underpinning is a significant investment in the long-term stability and safety of a building, and it's essential to allocate sufficient resources and work with qualified professionals to ensure that the work is done effectively and to a high standard.

How Long Will Underpinning Last?

When done properly by experienced professionals, underpinning is a long-term solution that should last for the lifetime of the building. It is designed to stabilise the structure and prevent further movement, so once the work is complete and the cause of the original issue has been addressed, there should be no need to repeat the process.

The durability of underpinning depends on a few factors, such as the method used, the quality of the materials, and the condition of the surrounding soil. Traditional mass concrete underpinning, for example, has been used successfully for decades and is known for its reliability. More modern methods, such as resin injection or mini-piling, can also be extremely effective if applied in the right circumstances.

Provided the building is maintained and no new issues develop, underpinning should remain effective for many years without any further intervention. As with any structural work, it is always worth keeping an eye on things and having periodic inspections, especially if the property is in an area with a history of ground movement or subsidence.

Will Underpinning Devalue My Property?

It's estimated that underpinning could reduce a property's value by 20% to 25%. This will depend on the extent of the original issue, how long ago it happened, and the quality of the work. If the underpinning work happened some time ago and there's been no further issue of subsidence since then, it may not have any impact on the property's value. However, it's worth noting that properties become more stable when they've been underpinned and may be better protected against future subsidence issues. In theory, an underpinned property may be more stable than properties that have never experienced issues with subsidence.

Can I Get a Mortgage on An Underpinned House?

So, does underpinning affect a mortgage? The quick answer is yes, underpinning can affect a mortgage. Getting a mortgage should be fairly straightforward if the subsidence problem or structural issues have been resolved and the underpinning is of a high standard. However, it largely depends on several different factors, for example:

How Long Ago Was the Subsidence?

Some lenders are only concerned about issues like subsidence if the issues occurred fairly recently. Many lenders aren't too concerned if the subsidence happened over 10 to 15 years ago. But you must prove that the property was successfully underpinned, and there have been no problems since.

How Severe Was the Subsidence?

Although the severity of subsidence can vary, if the underpinning work was completed to a high standard, how bad the subsidence was should be less of a deciding factor.

What Type of Underpinning was Done?

Lenders consider certain types of underpinning as more reliable than others. For instance, while some types of underpinning stabilise and strengthen the soil around the foundations, others completely rebuild and reinforce the foundations.

Which Are the Best Lenders for Mortgages on Underpinned Houses?

While each borrower's circumstances are different, each lender also has different eligibility criteria for an underpinned property mortgage. However, two of the leading lenders for mortgages on underpinned houses are:

Natwest

Natwest will lend on properties underpinned within the last ten years. However, they’ll largely be guided by the structural engineer's report and the valuer's feedback. They also require specific building insurance.

Nationwide Building Society

Nationwide will approve mortgages on properties underpinned in the last ten years, but only if the work was part of an insurance claim and has the appropriate guarantees.

Can You Get a Mortgage on an Underpinned Property of Non-Standard Construction?

Approval for mortgages on houses of non-standard construction will largely depend on the type of construction. Certain properties are considered more reliable by lenders. For instance, some lenders will outright refuse to lend on houses of steel-framed construction, while others will only exclude particular types of steel frames. Your mortgage broker can advise you on which lenders are suitable for your particular property.

Can You Get a Mortgage on an Underpinned House for Buy-to-Let?

Some lenders will lend on underpinned properties for buy-to-let, but you may find the process more complex than getting a standard mortgage. For instance, your lender will want you to prove that the rental income from the property will be able to cover the mortgage, including during those periods when you don't have a tenant. To secure a mortgage, you must satisfy these requirements and the lender's underpinned property requirements.

Can I Insure an Underpinned Property?

Some insurance providers are wary of insuring properties that have been underpinned as it shows structural weakness. But, while your choice of an insurer may be more limited than if you were buying a property without underpinning, many providers certainly offer this type of cover. However, insurance on an underpinned property is likely to cost more.

Can I Sell an Underpinned Property?

Yes, you can sell an underpinned property. However, you must be transparent with your estate agent and potential buyers about the underpinning work the property has had. Failing to declare that your home has been underpinned could lead to legal issues as the buyer will be protected by The Misinterpretation Act of 1967. You'll also need to be prepared to take a drop in price as underpinning can devalue a property by up to 25%. However, not all buyers are put off by a property because of previous structural issues. But they’ll likely want to investigate the situation further with a structural survey.

Can I Get a Mortgage on a House Requiring Underpinning?

Most lenders will consider it unmortgageable if a property requires underpinning due to subsidence. Subsidence, especially in severe cases, can cause serious damage to a property and make it uninhabitable, require expensive repairs, and even cause the building to collapse. A property must qualify for building insurance as part of mortgage providers lending conditions. However, insurers won't insure a property known to have subsidence problems.

In this situation, you may have to insure with a specialist insurer. In these issues where you can’t get a property on a mortgage due to subsidence, it will be worth considering alternative forms of finance, such as a bridge. This will allow you to purchase the property and to complete any remedial work to make it habitable, at which point you’ll be able to do a standard remortgage.

If the subsidence is historic and dealt with, or you organise for underpinning work to be carried out, most lenders will get a surveyor to check the subsidence issue is resolved. If the surveyor is satisfied with the work, the lender will likely review your mortgage application more favourably.

Could the Property I Want to Buy Be at Risk from Subsidence?

Some properties are more at risk of having subsidence than others. Some of the common risk factors to look out for include:

Type of Soil

Clay soil is a common cause of subsidence problems as it tends to crack and shrink in warm, dry weather, causing the ground to be unstable and unsettle foundations. Look to see if there are any visible cracks in neighbouring properties and the one you’re considering buying. This will indicate whether there's clay soil in the area.

Trees Near the Property

Trees can drain moisture from the soil, making it dry, causing it to sink and causing instability under the property's foundations.

Period Properties

Older foundations are often shallower than new-build properties and at a higher risk of erosion and subsidence.

Water Damage

Leaking drains, previous issues with flooding or damaged water mains can soften the ground and increase the risk of a property having subsidence.

Should I Buy an Underpinned House?

Lenders and buyers used to view subsidence as a much more serious issue than it is now. But thanks to modern techniques such as underpinning, these properties are frequently bought and sold without too many issues. Properties that have been underpinned can be more structurally stable than those that have never had subsidence problems. However, as a buyer, you should ensure that the full structural survey shows no further problems with the structure of the building.

Even if the structural issues are historic and resolved, you may still face higher home insurance premiums which your mortgage lender will consider when assessing your affordability. You'll also need to consider the property's saleability in the future. While an underpinned property may not concern you, it may concern potential buyers in the future, especially if cracks are still visible.

If you do decide to buy a property that's been underpinned, make sure you have buildings insurance arranged from the day you exchange. Don't wait until you move in.

Should I Buy a House that Needs Underpinning?

If you've got your heart set on a house but it needs underpinning, you must get a full structural survey of the property. The surveyor will tell you how serious the problems are and whether underpinning will be able to rectify them. They will also be able to give you an idea of potential issues in the future which may affect the property. Don't panic if you discover that the property you’re looking to buy needs underpinning. The property may not have had subsidence at all, although the structural survey will be able to highlight exactly what the problem is.

However, if the issue is related to severe subsidence, you may struggle to get a mortgage on it. In this situation, you may need to get a bridging loan to purchase the property. Once you've underpinned the property and the subsidence problem is resolved, you can then get a mortgage. Alternatively, some lenders will approve a mortgage but release the funds once the underpinning is completed.

How To Secure a Mortgage on An Underpinned Property

If the surveyor is satisfied with the quality of the underpinning and the work has resolved the issue, you shouldn't have too many problems getting a mortgage. It should be much the same as if you were getting a mortgage on a "non-underpinned" property. As with any mortgage, your credit history, income, size of your mortgage deposit, and affordability will all help to persuade a lender to approve your application.

If you have any questions about mortgages on underpinned properties, get in touch with our independent mortgage experts. At John Charcol, we have access to a huge range of mortgage products and lenders, including mortgages for underpinned properties. We can help you find the right mortgage for your circumstances. Contact us today on 0330 433 2927 or submit an online enquiry to find out more.

First-Time Buyer Mortgages

Discover the best first time buyer mortgage rates available and the latest advice from John Charcol: mortgage broker for first time buyers.

Applying for a Mortgage

Applying for a mortgage couldn’t be simpler with our easy and simple guide from application to accepting your offer.

How Much Can I Borrow?

This mortgage calculator examines your income and works out how much money a mortgage lender might provide you with

House Buying Mortgage Guide

Are you looking to buy your first home? Or perhaps want to move to a new area? Our step-by-step guide will tell you everything you need to know about buying a house.

Help to Buy Guide

Support from the government-backed Help to Buy initiative is available for first-time buyers and existing homeowners who are finding it difficult to move up the housing ladder.

House Mortgage Deposit

Saving a mortgage deposit for a house is definitely one of the biggest hurdles you face as a buyer. In our guide we explain how deposits work and ways you can save.

Mortgage Deposit Amounts

Learn all about the different mortgage deposit amount options, how they affect your mortgage, how they vary depending on what type of borrower you are & more.

Funding Home Improvements

There are a few ways to finance work on a house: get a home improvement loan, remortgage for home improvements, ask your lender for a further advance & more

Mortgage Glossary

On this page you’ll find our detailed mortgage terminology glossary. There’s a lot of jargon out there but we’re here to make it easy.