Solar power is more popular than it's ever been. Many homeowners in the UK are installing solar panels on their homes, making buying homes with solar panels increasingly common. Whilst installing solar panels offers many environmental benefits, they can also reduce your household's energy bills. But how do lenders view solar panels, and can they affect your chance of getting a mortgage? This article will look at what you need to know about solar panels and mortgages and the issues you need to be aware of.

The Topics Covered in this Article Are Listed Below:

- What Are Solar Panels?

- Can You Get a Mortgage on a House with Solar Panels?

- Why Is It Difficult to Get a Mortgage with Solar Panels?

- Which Lenders Provide Mortgages on Solar Panel Properties?

- What Do I Need to Know About Buying a House with Leased Solar Panels?

- Do Solar Panels Devalue Properties?

- Can I Remortgage if I Have Solar Panels on My Home?

- Can I Remortgage to Finance Solar Panels for My Home?

- What Do I Need to Consider When Selling a Home with Solar Panels?

- Can I Buy Out a Solar Panel Lease?

- How Much Will It Cost to Remove Solar Panels?

- Should I Buy a House with Solar Panels?

- What to Ask When Buying a House with Solar Panels?

What Are Solar Panels?

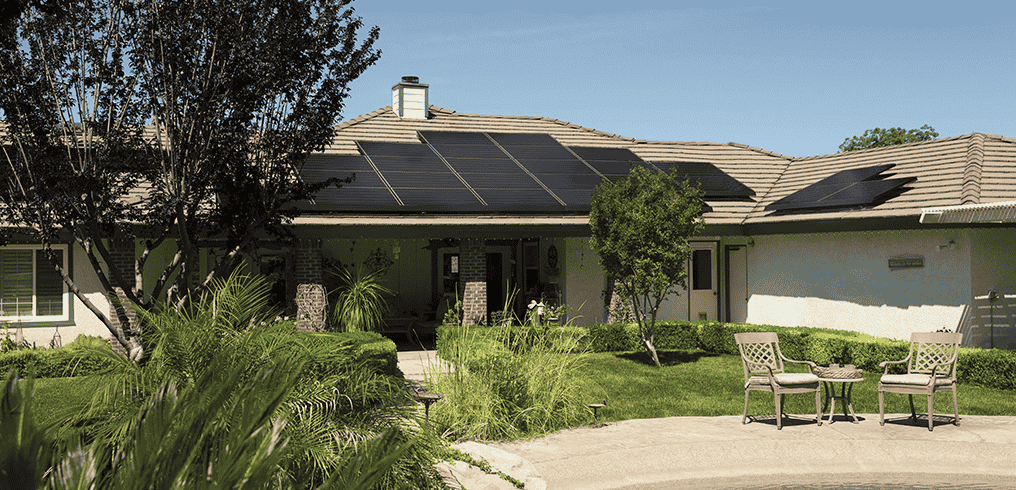

In simple terms, solar panels are 3 dimensional frames usually put on roofs that contain a group of solar cells that absorb energy from the sun and turn it into electricity or heat. There are two types of solar panels. Solar thermal panels and photovoltaic solar (solar PV). There are several reasons why a homeowner may choose to install solar panels, for example:

- Provide cheap or free electricity

- Environmental benefits of renewable energy

- The government's Feed-in-Tariff scheme paid for green energy

Can You Get a Mortgage on a House with Solar Panels?

Yes, you can typically get a mortgage on a house with solar panels. In fact, having solar panels installed on a property can sometimes be seen as a positive factor by lenders and may even increase the property's value.

However, there are a few important considerations to keep in mind:

- Appraisal and valuation - when applying for a mortgage on a property with solar panels, the lender will likely require an appraisal to determine the property's value. Appraisers will consider various factors, including the value added by the solar panels. Generally, if the solar panels are owned outright and in good working condition, they may add value to the property. However, if the panels are leased or have significant maintenance issues, their impact on the property's value may be limited

- Ownership and financing options - if the solar panels are owned outright, they are considered part of the property and can be included in the mortgage financing. However, if the panels are leased or financed through a Power Purchase Agreement (PPA), the financing arrangement may need to be transferred to the new homeowner or paid off before the sale can proceed. Lenders may have specific requirements regarding the transfer or payoff of solar panel financing

- Assessment of solar panel system - lenders may require an assessment of the solar panel system to ensure that it is properly installed, functioning efficiently and compliant with relevant regulations and building codes. This assessment may be conducted by a qualified solar energy contractor or inspector

- Insurance considerations - homeowners insurance policies typically cover solar panel systems as part of the property, but it's important to verify coverage with your insurance provider. Lenders may also require proof of insurance coverage for the solar panels as a condition of the mortgage

- Tax and financial incentives - solar panels may be eligible for tax credits, rebates, or other financial incentives, which can help offset the cost of installation. These incentives may affect the property's overall affordability and financial considerations for both the buyer and the lender

Overall, obtaining a mortgage on a house with solar panels is typically feasible, but it's important to communicate with your lender and ensure that all aspects of the solar panel system are properly documented and accounted for in the mortgage process. Working with professionals experienced in solar energy and real estate transactions can help streamline the process and ensure a successful outcome.

Owned Solar Panels VS. Leased Solar Panels

Whether or not you'll have problems securing a mortgage on a property with solar panels will likely come down to whether the solar panels are owned by the previous homeowner or leased. Before completing the property purchase, you must determine whether the solar panels will be part of the sale. If the previous owner has bought the solar panels outright, they may want to take them to their next property. Some solar panel lease agreements also allow this.

If the solar panels are staying where they are and will be part of the property sale/purchase, you’ll likely face one of two possible scenarios:

Owned Solar Panels and Mortgages

The ideal scenario for most buyers would be that the seller paid for the solar panels and left them at the property for the new owners. The hassle of removing and reinstalling solar panels often means sellers decide to leave them. They'll also have to pay for any property damage caused by removing the panels. As a buyer, you’re unlikely to face any issues when applying for a mortgage on a property with solar panels. After all, you'll get a mortgage on a property with free solar panels.

Leased Solar Panels and Mortgages

If the property you’re buying has solar panels that are leased or rented, things can get a little more complicated. Some lenders refuse to lend on properties that have leased solar panels, while others that do lend on them have strict criteria. If the lease terms state that the panels' financial responsibility transfers to the new property owners, lenders will want to work that into their affordability assessments.

However, the previous property owners may continue to be responsible for paying off the outstanding lease on the solar panels. In that case, there will likely be certain legal issues lenders will want to consider before deciding to approve a mortgage.

Why Is It Difficult to Get a Mortgage with Solar Panels?

While homeowners may benefit from the cost savings on the energy they consume thanks to the solar panels, this might also make getting approved for a mortgage more challenging.

Installing solar panels can cost over £6,000, so "Rent a Roof" schemes that offered to install solar panels for free and cover their maintenance and insurance became popular. As part of the agreement, homeowners must keep the panels for around 25 years, while the companies earn income by selling energy to the National Grid through Feed-In Tariffs.

While Feed-In Tariffs and Rent a Roof schemes have ended, past contracts with solar panel companies have many years left to go. If a homeowner sells their home, the solar panels and the ongoing contract are passed on to the new homeowners. This can put off both prospective buyers and mortgage lenders, especially as a crucial part of the house, the roof, is subject to a complex lease agreement, complicating the valuation of the property.

What Do I Need to Know About Buying a House with Leased Solar Panels?

There are several things you should consider before buying a house with leased solar panels installed, for example:

- Some lenders have concerns that a large part of the roof is essentially rented out to a solar energy company and not owned outright by the homeowner

- Many of the solar power companies that originally came to market have now stopped trading, so it can be difficult to determine who owns the panels

- If the energy company has passed the management of the solar panels to an agent, the agent may require a fee when the property is sold

- The solar power company might have the right to lease the roof indefinitely under the 1954 Landlord & Tenants Act and can legally rent the roof area longer than the typical 25 years

- The homeowner may have to get permission to extend the property or sell it under the lease agreement with the power company

It's much more straightforward if the homeowner owns the solar panels outright. If the seller leaves the solar panels at the property when they move, ownership will automatically transfer to the new homeowner. However, they’ll also have to take responsibility for the maintenance of the panels.

Which Lenders Provide Mortgages on Solar Panel Properties?

As the number of homes in the UK with solar panels has soared recently, many high street lenders have updated their terms to accommodate these types of properties. For instance, Nationwide, Halifax and Accord are just some of the lenders that will consider mortgage applications for properties with solar panels. However, each lender has its own lending criteria that’ll consider your specific circumstances.

Do Solar Panels Devalue Properties?

Whether solar panels devalue properties largely depends on how long ago they were installed. If they were fitted more than ten years ago, for example, you’re in a good position to prove your energy savings to potential buyers for that period. However, some research suggests that while solar panels don't add much value to a property price, they’re considered an attractive addition by many potential homebuyers.

Can I Remortgage If I Have Solar Panels on My Home?

It’s possible to remortgage if you have solar panels on your home. However, it does depend on your circumstances and the lender's criteria. If you have purchased the solar panels and own them outright, there are fewer risks, and most lenders will be satisfied. But if you’re renting solar panels, you may find it more difficult, although this will depend on the terms of the lease agreement.

Can I Remortgage to Finance Solar Panels for My Home?

Yes, you can remortgage your home to finance the installation of solar panels. Remortgaging involves replacing your existing mortgage with a new one from a new lender, often with different terms and conditions. For example, you may borrow more than the amount remaining on your existing mortgage in order to fund home improvements, such as installing solar panels.

Many lenders will let you remortgage your home to raise funds for solar panels and it is common for people to remortgage for home improvements. However, you must ensure that you factor in the maintenance of the solar panels into your calculations. If you own your home outright, getting a remortgage for the amount you require should be fairly easy, especially as the amount you'll need will be quite small in relation to the value of your home.

What Do I Need to Consider When Selling a Home with Solar Panels?

The prospect of buying a home that's energy efficient can be appealing to many buyers. However, there's a considerable amount of information a potential buyer needs.

When You Lease the Panels

If the solar panels are leased, the buyer's solicitor may request:

- Copy of the standard 25 year lease

- Details of building and planning regulations consent

- Details of any breaches of the terms of the lease agreement

- Details of any payments made on the solar panels and insurance

If the property buyer decides they don't want to take over the lease of the solar panels, terminating the lease will incur a cost. You'll need to determine who will pay the costs in this scenario.

When You Own the Panels

If you own the solar panels on the property you’re selling, you'll need to provide your buyer with all the relevant documentation related to the panels. You'll also need to provide them with evidence of the benefits of panels. For example:

- Up-to-date service record that shows the solar panel system is in good working order

- Feed-in Tariff statements

- Electricity bills from before and after the solar panel installation

Can I Buy Out a Solar Panel Lease?

Some solar panel leases feature buy-out clauses enabling a new owner to buy their way out of the lease. The buy-out cost is usually equivalent to the price of installation, around £10,000 to £15,000. If you want to buy out your solar panel lease, you'll have to discuss this with the leased panel owner (who might be the property's previous owner) or the installation company. If the property looks to be difficult to mortgage with the solar panels, you might be able to arrange for the buy-out to happen before completion.

The lender will be more likely to lend on this basis. If there is no buy-out clause in the lease, this may become more expensive and complicated. If this is the case, you must speak to your lender and solicitor as early as possible.

If you successfully buy out the lease, you’ll become the owner of the solar panels and responsible for their maintenance costs. Once you've settled the lease, you can keep or remove the panels. It's important to know that lease agreements often come with very high early repayment charges, similar to mortgages. If you’re selling your home, you might consider passing on the lease to the new buyer, assuming they can get a mortgage that allows them to do so.

How Much Will It Cost to Remove Solar Panels?

The cost to remove solar panels can vary depending on several factors, including the size and type of the solar panel system, the complexity of the installation, the accessibility of the panels and the location of the property. You can expect to pay anything from £500 to £1,500 to remove them. This amount doesn't include any costs you'll have to pay to replace parts of the roof if required.

Here are some cost considerations to keep in mind:

- Labour costs - labour costs typically make up a significant portion of the total cost to remove solar panels. The complexity of the removal process, such as whether the panels are roof-mounted or ground-mounted and the ease of access to the installation site, can influence labour costs. Additionally, if specialized equipment or expertise is required for the removal, it may increase labour expenses

- Equipment and materials - the cost of equipment and materials necessary for removing solar panels, such as tools, safety equipment, and protective gear, should be factored into the overall cost. Depending on the condition of the panels and the installation, additional materials such as replacement roof tiles or sealants may be needed

- Transportation and disposal - transporting the solar panels from the installation site to the disposal facility can incur additional costs, particularly if the panels need to be transported over long distances or require special handling. Disposal fees may also apply, depending on local regulations and the disposal method chosen (e.g. recycling or landfill)

- Roof repair or restoration - in some cases, removing solar panels may reveal damage to the roof or require repairs to restore the roof's integrity. The cost of roof repairs or restoration should be considered when estimating the total cost of removing solar panels

- Contractor fees - if you hire a professional contractor or solar panel removal company to handle the removal process, their fees will contribute to the total cost. Contractor fees can vary depending on the contractor's experience, expertise and geographic location

Overall, the cost to remove solar panels can range depending on the specific circumstances of the installation. It's advisable to obtain multiple quotes from reputable contractors or removal companies to compare costs and ensure that you're getting a competitive price for the removal services. Additionally, consider consulting with a qualified solar energy professional or contractor to assess the condition of your solar panel system and provide an accurate estimate of removal costs based on your individual needs and requirements.

Should I Buy a House with Solar Panels?

The issues surrounding lease agreements may put off some buyers. However, in most cases, they can be resolved. Most lenders will approve a loan on a property with leased solar panels provided the lease meets certain conditions. For instance:

- The panels can be removed without incurring missed Feed-in Tariff payment penalties

- The installation of the solar panels is insured and approved

- The installing company is accredited by the Microgeneration Certification Scheme (MCS)

The more information you can get from the seller about the solar panels, including copies of the lease, building and planning consent, and details of payments, the easier it’ll make your property purchase.

Property Renovations

When purchasing a property with solar panels, it's important to remember that you may not be able to do an extension, loft conversion or other renovations that may disturb the solar panel installation.

What to Ask When Buying a House with Solar Panels

Before you commit to buying a house with solar panels, you should try to get the answers to the following questions:

Are the Solar Panels Fitted Securely and Connected Properly?

If you have to pay someone to ensure the panels are fitted to your roof securely and won't come sliding off, it will eat into the profits you may make from them. Also, if the panels are properly connected, you won't get as much electricity as you should. Ask your surveyor to check that the solar panels are installed correctly.

What Are the Details of the Installation?

Knowing when the solar panels were installed will help you understand how much longer they'll be good for. Also, find out which company installed the panels, so you know who to contact if you have any queries or require maintenance.

How Long Does the Warranty Run For?

A warranty for a solar panel usually lasts for around 25 years. If that timeframe is coming to an end soon, it's good to know.

Do the Panels Come with a Solar Battery?

Solar batteries store solar panels' electricity, helping homeowners save more. They can cost between £2,000 and £6,000, but if the property already has one, it’ll save you the initial outlay cost.

How Much Income Can I Expect to Get from Solar Panels?

The income you can expect from solar panels largely depends on the installation size. For example, smaller installations may generate only a modest income. However, you can use the electricity your solar panels produce, helping you reduce your electricity bills. Although the savings you'll make will depend on the system size, how much electricity you use and whether you're at home during the day.

According to estimates from the Energy Saving Trust, an average household with a 4.2 kilowatt-peak solar panel system could potentially reduce their energy bills by £165 to £405 a year. The Energy Saving Trust's solar panel calculator will give you an idea of how much you can expect to save on your fuel bills by installing solar panels.

If you are considering purchasing a property with solar panels already installed, contact our team of independent mortgage advisors at John Charcol. We have extensive experience helping buyers arrange mortgages on these types of properties. Contact us on 0330 433 2927 or submit an online enquiry.

First-Time Buyer Mortgages

Discover the best first time buyer mortgage rates available and the latest advice from John Charcol: mortgage broker for first time buyers.

Applying for a Mortgage

Applying for a mortgage couldn’t be simpler with our easy and simple guide from application to accepting your offer.

How Much Can I Borrow?

This mortgage calculator examines your income and works out how much money a mortgage lender might provide you with

House Buying Mortgage Guide

Are you looking to buy your first home? Or perhaps want to move to a new area? Our step-by-step guide will tell you everything you need to know about buying a house.

Help to Buy Guide

Support from the government-backed Help to Buy initiative is available for first-time buyers and existing homeowners who are finding it difficult to move up the housing ladder.

House Mortgage Deposit

Saving a mortgage deposit for a house is definitely one of the biggest hurdles you face as a buyer. In our guide we explain how deposits work and ways you can save.

Mortgage Deposit Amounts

Learn all about the different mortgage deposit amount options, how they affect your mortgage, how they vary depending on what type of borrower you are & more.

Funding Home Improvements

There are a few ways to finance work on a house: get a home improvement loan, remortgage for home improvements, ask your lender for a further advance & more

Mortgage Glossary

On this page you’ll find our detailed mortgage terminology glossary. There’s a lot of jargon out there but we’re here to make it easy.