Your credit report is crucial in deciding which financial products you’re eligible for. A poor credit report could hold you back when borrowing money, including getting a mortgage. However, you can make it easier for yourself if you learn what can harm your credit report and what steps you can take to improve your financial profile. In this guide to understanding your credit report, we ’ll look at how credit reports and scores work, why you should frequently check yours, and how to improve it.

The Topics Covered in this Article Are Listed Below:

What Is a Credit Report?

A credit report is a historical record of your financial activity compiled by credit reference agencies. It reflects how you manage and repay debt, acting as a financial CV for lenders and other firms to look at before doing business with you. A credit report contains a record of how and when you pay your bills, how much debt you have and how long you've had credit accounts. It also shows your current and previous addresses and any financial associations you have, for example, if you share a joint account with someone.

When you apply for any type of credit, such as a mobile phone contract, credit card, mortgage or overdraft, companies will look at your credit report to see how much credit you've previously had and how you've managed the repayments. The lender will use this information to help them decide whether you'll be likely to repay any credit they give you. They'll look at the following:

- How much debt do you have

- Whether you generally pay your debts on time

- How much credit you’ve taken out in a short space of time

- How much credit is available to you

Even if you’ve never borrowed money or used a credit card, you’ll still have a credit report but it just may not have much information on it. Actions like paying your phone bill and being on the electoral register will all appear on your credit report.

What Information Is on Your Credit Report?

Your credit report is a presentation of the data stored in your electronic credit file at one of 3 national credit bureaus: Equifax, TransUnion and Experian. Each bureau has the same information but presents the data in different formats. Data held on your credit report includes:

- Your address details, such as electoral roll information about your current and previous addresses

- Any financial credit agreements you've had, such as credit cards, loans, overdrafts and mortgages. This will also include any late or missed payments

- Public records such as county court judgements (CCJs), insolvencies or bankruptcies

- Your financial associations, such as if you've got a joint mortgage with someone

Not recorded on your credit report is information about your employment history, criminal record, savings account, medical records, political affiliations, religion or ethnicity.

Why Is It Important to Check My Credit Report?

You'll have a credit report if you’re 18 or older and have taken out any credit agreement such as an overdraft, mobile phone contract or mortgage. It's a good idea to regularly check your credit report, ideally once a year at the very least, before applying for credit. Checking your credit lets you spot any mistakes that could affect your ability to get approved for credit or access the best credit deals. Even seemingly small mistakes can seriously affect you. You'll also be able to identify if there's any fraudulent activity, such as credit applications made in your name by someone else.

As your information can be slightly different across the 3 credit reference agencies, it's a good idea to check all 3. You won't be penalised for checking your report and there's no limit to the number of times you can do so.

Can I Check My Credit Report for Free?

You’re legally entitled to access your credit report for free. While these statutory reports don't include your credit score, they will give you an overview of your credit history. For a monthly fee, the main credit reference agencies offer more comprehensive services, including unlimited access to your credit report and score. You can also get alerts about any significant changes to your report. It’s possible to get your credit report and score for free, with the tips below.

Experian

You can access your Experian credit report free by joining the Money Saving Expert Credit Club. You can also sign up for a free trial of Experian's CreditExpert service, which usually costs £14.99 a month.

Equifax

If you sign up for Clearscore, you can get a free monthly Equifax report. You can also get a free month's trial of its full credit monitoring service, which usually costs £7.95 a month.

TransUnion

Credit Karma provides free access to credit reports on TransUnion.

How Do I Correct Mistakes on My Credit Report?

If you identify a mistake on one or more of your credit reports, you must rectify it as soon as possible. Not doing so could have serious implications on your ability to get credit in the future. Contact the credit reference agency or the company that provided the information directly to correct it. They’ll then contact the lender to verify the information, but it can be quicker to contact the lender yourself. The credit reference agency must amend or remove the entry or take no action within 28 days of your request. The lender must approve the removal of an error from your credit report. If they don't, you'll have to add a "notice of correction" to your file explaining in 200 words why there’s an error.

What's the Difference Between a Credit Report and a Credit Score?

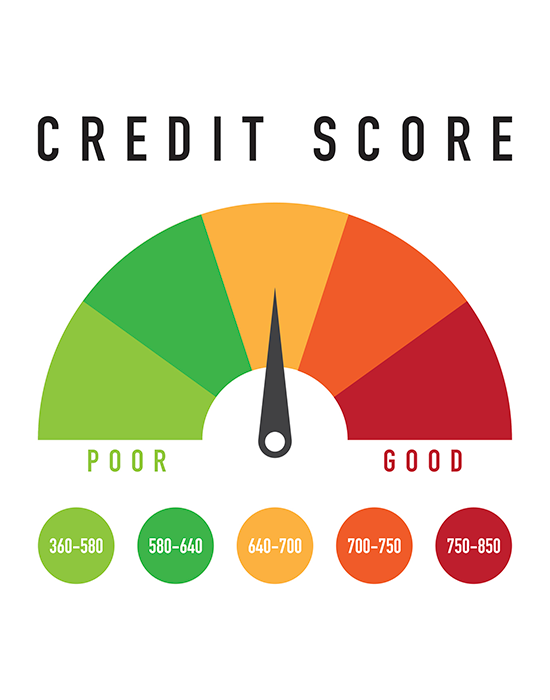

While your credit report is a summary of your credit history, your credit score is a 3 digit number, usually between 300 and 999, that reflects your overall credit risk. It provides a quick at-a-glance summary of your overall credit risk. The higher the credit score, the more likely you’re to have a good history of using credit responsibly.

If you have a lower credit score, it can suggest to prospective lenders that you need to improve your financial behaviours before taking out more credit. Scoring models are used to calculate scores that consider your credit report information, such as the amount of debt you have, your payment history and how long you've been managing credit. There's no single credit score system in the UK, as each credit reference agency uses its own scoring method so it's a good idea to check all 3.

What Is a Good Credit Score?

As each credit reference agency has its own scoring system, here's what the 3 main credit reference agencies consider a good credit score:

- Equifax: 420 to 465

- Experian: 881 to 960

- TransUnion: 604 to 627

To access the best possible mortgage rates available, it's a good idea to try to boost your credit score up to the excellent category across all the agencies:

- Equifax: 466 to 700

- Experian: 961 to 999

- TransUnion: 628 to 710

What Negatively Affects a Credit Score?

While each lender has their own criteria for reviewing credit scores and what they’ll consider before lending, some things typically lower your chance of getting credit.

Late or Missing Payments

If you're frequently late making a repayment or miss payments altogether, this could be recorded as a default on your credit report and significantly lower your credit score for up to 6 years.

Regularly Setting Up New Accounts

Setting up a new bank account should only temporarily decrease your credit score. Avoid doing this too frequently, to allow your score a chance to recover.

Apply for Credit Too Frequently

Submitting multiple credit applications can adversely affect credit scores, regardless of whether it's successful. This is because each application records a hard search on your credit report.

Getting Close to Your Credit Limit

If you often find yourself getting close to your credit limit or using your wholeoverdraft, lenders may consider that you're in financial difficulty or too reliant on credit.

Little or No Credit History

You may think no credit history is good, but you probably have a very low credit score if you've never had credit before. Lenders like to see that you have a good record of responsible borrowing, which helps them determine if you're likely to repay them on time.

Getting More Credit Than You Can Afford

If you struggle to pay off your debts and have to enter into an IVA (individual voluntary arrangement) or get a debt relief order, it will reduce your credit score significantly and make it harder for you to borrow money in the future.

You've Had Multiple Homes

If you move house frequently, this can negatively affect your credit score as it can show a lack of financial stability. It may also concern lenders that they won't know where to find you if you begin to miss payments.

Errors on Your Credit Report

Whether it's because of identity fraud or even a simple mistake, errors on your credit report can damage your credit score.

What Is the Minimum Credit Score I Need for a Mortgage?

There's no precise credit score needed to be eligible for a mortgage. Lenders consider several factors beyond a credit score. However, the higher the credit score, the better your chance of securing a mortgage offer and a favourable rate. If your credit score is below what's considered good across the different agencies, work on improving this before trying to get a mortgage.

Are There Mortgage Providers That Will Accept Poor Credit Scores?

You'll likely be declined by some high street lenders like HSBC if you have a CCJ on your credit report or have a history of missing payments or maxing out your credit. Some providers will approve mortgage applications from customers with poor credit scores or who have been rejected for a mortgage elsewhere, known as "bad credit mortgages". But you'll have limited options and likely have to pay higher fees and interest rates. You can also expect to put down a larger deposit with a bad credit mortgage. Each lender has its own criteria for what it considers bad credit, so it's a good idea to compare the deals available with the help of a specialist mortgage broker like John Charcol.

How Can I Get a Mortgage with a Poor Credit History?

There are various things you can do to improve your credit score and chances of getting approved for a mortgage.

Pay All Your Bills on Time

Build up a good track record of paying all your bills on time. It can indicate unreliability if you have a history of late or missed payments to lenders or outstanding defaults. Lenders will see you as less of a lending risk if you have settled defaults on your credit report.

Pay Credit Commitments by Direct Debit

If you currently pay your bills ad hoc, try to move them to direct debit. Lenders like to see consistency and a record of payments taken on time shows you to be financially stable.

Avoid Using All Your Available Credit

Maxing out your credit cards suggests you live beyond your means and push your finances to the absolute limit. A good rule of thumb is to use less than 30% of your credit limit.

Register on the Electoral Roll

Registering on the electoral roll for at least 3 years before you submit a mortgage application makes it much easier for lenders to trace your address history.

Never Use Payday Loans

Taking out a payday loan will signal to potential lenders that you’re financially unstable.

Always Pay Your Rent on Time Each Month

If you fail to pay your rent on time or miss payments entirely, your landlord may take out a CCJ against you, which will have a big adverse impact on mortgage approval.

Check Your Credit Report

Look at your credit report to see when you've had missed payments and to check for any fraudulent activity that could harm your credit score.

Can I Get a Mortgage with No Credit History?

If you have no credit history, lenders don't have a view on how you manage credit, meet your repayments on time, how much credit you have or check your identity. This can make lenders more reluctant to lend to you. In this case, a specialist lender can help, who will consider your mortgage application on its own merits. In this case, your financial circumstances, including employment history, income, savings and investments, will be more closely examined.

How to Get a Mortgage with No Credit History?

If you currently have no credit history, you can improve your chances of being accepted for a mortgage by:

Using a Specialist Broker

A specialist mortgage broker like John Charcol can help you find the most suitable mortgage for your circumstances. We have access to the entire market, including adverse credit lenders prepared to lend to people without a credit history.

Try to Build Up Some Credit History

You can start building a credit history fairly easily and quickly by registering to vote, taking out a credit card, taking over responsibility for household utility bills, or switching to your own mobile phone contract if you currently share it with a family member.

Collate Any Supporting Documents

With no credit history, you may have to gather additional evidence for lenders to support your mortgage application. For instance, if you've recently returned to the UK, check if you have any evidence of non-UK bank accounts or work you've carried out abroad that’ll explain why there's a gap in your financial history. Your specialist broker at John Charcol can advise you on the most relevant documentation you'll need.

Once you've successfully built up your credit score as much as you can and your credit report is looking healthier, contact our team of mortgage brokers and we'll help you find the best mortgage deal available.

Understanding Your Credit Report Summary

By getting to know your credit report and score, you'll have a good understanding of your financial position and how potential lenders perceive you. If your credit report shows that you have a low credit score, work on improving it with our handy tips.

If you're concerned about the impact of your credit history on your mortgage application or just would like some specialist mortgage advice, our team at John Charcol will be happy to help. Contact us on 0330 433 2927 or submit an online enquiry.

First-Time Buyer Mortgages

Discover the best first time buyer mortgage rates available and the latest advice from John Charcol: mortgage broker for first time buyers.

Applying for a Mortgage

Applying for a mortgage couldn’t be simpler with our easy and simple guide from application to accepting your offer.

How Much Can I Borrow?

This mortgage calculator examines your income and works out how much money a mortgage lender might provide you with

House Buying Mortgage Guide

Are you looking to buy your first home? Or perhaps want to move to a new area? Our step-by-step guide will tell you everything you need to know about buying a house.

Help to Buy Guide

Support from the government-backed Help to Buy initiative is available for first-time buyers and existing homeowners who are finding it difficult to move up the housing ladder.

House Mortgage Deposit

Saving a mortgage deposit for a house is definitely one of the biggest hurdles you face as a buyer. In our guide we explain how deposits work and ways you can save.

Mortgage Deposit Amounts

Learn all about the different mortgage deposit amount options, how they affect your mortgage, how they vary depending on what type of borrower you are & more.

Funding Home Improvements

There are a few ways to finance work on a house: get a home improvement loan, remortgage for home improvements, ask your lender for a further advance & more

Mortgage Glossary

On this page you’ll find our detailed mortgage terminology glossary. There’s a lot of jargon out there but we’re here to make it easy.