If you’re self-employed, getting a mortgage can seem like a complicated process, and coupled with bad credit, can seem almost impossible. But the good news is, even if you’re a self-employed person with poor credit, you almost definitely still have options.

As a self-employed person you still have the same mortgage options available to you as an employed person, the only difference being the information that a lender will ask you to provide. With bad credit, you’re in exactly the same boat as someone who’s employed and will likely need a specialist adverse credit lender. Using an expert adverse credit mortgage broker like John Charcol can help you work out all your available self-employed mortgage options and decide which one is right for you.

Let’s take a closer look at how you can get a mortgage if you're self-employed with bad credit, and how, as experienced bad credit mortgage brokers, we can help.

The Topics Covered in this Article Are Listed Below:

- Why Is Bad Credit an Issue When Applying for a Mortgage?

- What Factors Can Affect My Credit Score?

- Can You Get Self-Employed Mortgages with Bad Credit?

- What Are Self-Employed Bad Credit Mortgages?

- Do I Need a Broker if I'm Self-Employed with Bad Credit?

- What Criteria Will I Need to Meet to Get a Self-Employed Bad Credit Mortgage?

- Can I Remortgage if I'm Self-Employed with Bad Credit?

Why Is Bad Credit an Issue When Applying for a Mortgage?

Whether you’re employed or self-employed, a first-time buyer or looking to remortgage, having poor credit can affect your chances of being approved for a mortgage loan. Your credit rating, although not the only component of a standard mortgage assessment, is a critical factor.

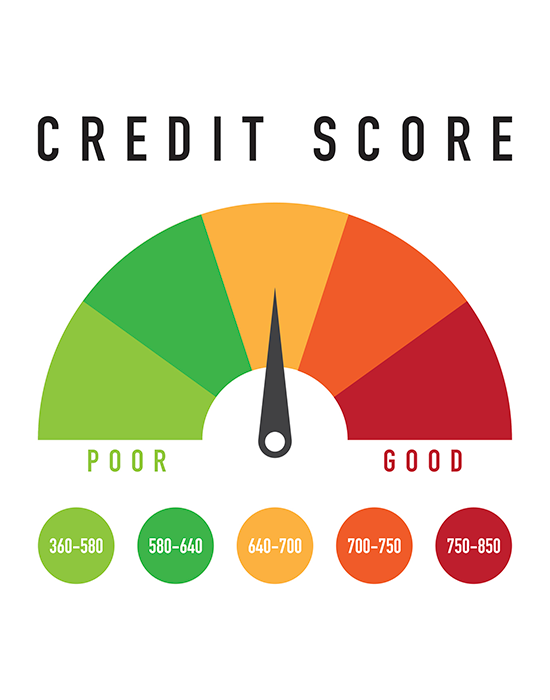

Most high street lenders use automated underwriting processes that pull in information from your mortgage application along with data from credit reference agencies like Equifax, Experian, Crediva and TransUnion. These agencies will hold various information on your credit profile including any credit accounts you hold, your payment history, any adverse credit events and your credit score.

As lenders receive so many mortgage applications, their automated process tends to filter out and automatically reject applicants with low credit scores or bad credit events on their profile. This is why your credit score plays such an important part in securing a standard mortgage loan, and why bad credit can stop you from getting approved through normal channels.

What Factors Can Affect My Credit Score?

Lots of different factors are taken into account when calculating your credit score. It’s not just about having a record of good financial management, it’s also about proving who you are, where you live and demonstrating that you have experience with managing credit. Factors that can affect your credit rating include:

- Having no or little credit history - if you aren’t able to show that you’ve already used credit, whether through a mobile phone contract, store card or car loan, lenders can’t be as assured that you’re a responsible borrower who can make repayments

- Your credit history isn’t very long - even if you currently have credit accounts, if you haven’t had them for very long, it’s more difficult to evidence to a lender that you have a long and reliable record of paying back borrowed money

- Missed or late payments - bad credit is most commonly associated with missing or making late payments. Although credit cards, mortgages and personal loans are all obvious forms of credit accounts, other missed or late bills will be taken into account too. Missed or late payments on phone or utility bills can also be an indication of more general money management issues

- You’re not registered on the electoral roll - a factor that’s sometimes overlooked, but simply joining the electoral register is a way of proving where you live and who you are and can instantly improve your credit score

- You have a (CCJ) county court judgement on your record - if you have a legal action that’s been taken against you to repay a debt, lenders won’t be assured that you’re a responsible person who pays their debts in full and on time

- Your credit utilisation is high - credit utilisation is a measure of how much available credit you use. The lower your credit utilisation the better. If, for example, you’re using 90% of all your overdraft and credit card allowances, this would negatively impact your credit score

Can You Get Self-Employed Mortgages with Bad Credit?

If you have bad credit, it’s still possible to get a self-employed mortgage, but your options will be more limited and it’s likely to be a more complex process. Because of a bad credit event in your history, you’ll also be seen as a higher-risk borrower, so although you might still be approved for a mortgage, you should expect your mortgage rates to be more expensive.

As with anyone applying for a mortgage with bad credit, if you’re self-employed with adverse credit, whether your mortgage is approved or not will depend on how recent and how serious any adverse credit events on your profile were.

For instance, if it was a relatively minor incident, like a missed store card payment, most lenders will be happy to overlook it. But, if it’s more serious like a CCJ, defaulting on your mortgage payments or bankruptcy, a lot of lenders will see you as too risky and their standard policies and affordability assessments simply won’t allow them to approve your mortgage application.

Usually, the best and often only route to buying a house with bad credit, especially if you’re self-employed, is to seek out a bad credit mortgage from a specialist lender. These specialist bad credit lenders often only work via intermediaries like John Charcol, and as experienced adverse credit brokers, we can help you find suitable lenders.

Can I Get a Contractor Mortgage with Bad Credit?

As with anyone who’s self-employed, if you’re a contractor, even securing a normal mortgage loan through traditional high street banks and building societies can be tough if their automated assessments aren’t geared up for a contractor’s more unusual earnings profile.

If you add bad credit to the mix, it can be even more difficult, but that doesn’t mean you can’t get a mortgage. Like anyone who’s self-employed, it’s best to engage a bad credit specialist lender through a mortgage broker who can help with your more nuanced employment status and your poor credit history.

What Are Self-Employed Bad Credit Mortgages?

At John Charcol, we have access to specialist lenders who can offer mortgages to individuals who’re self-employed with bad credit. These types of mortgages are known as bad credit, or sometimes adverse or subprime, mortgages.

Bad credit mortgage lenders take a more personal and flexible approach to approving mortgages for people with poor credit and in non-standard employment compared to most high street lenders.

It’s important to be aware though, that not all bad credit lenders have the same eligibility criteria. For example, some will be happy to take on customers who have missed a bill payment in the last 6 months, whereas others will only accept missed payments older than 2 years, and some will be happy to approve applicants with debt management plans (DMP) or individual voluntary arrangements (IVA), where others won’t. So, it’s not a one-size-fits-all industry.

This is where we can help. As an experienced adverse credit mortgage broker, we have a network of lenders specialising in bad credit mortgages for self-employed people. Our in-depth knowledge of lenders’ different eligibility criteria means we can match your needs and circumstances to the right lenders who are more likely to approve your mortgage application and offer you the best rates.

Do I Need a Broker If I’m Self-Employed with Bad Credit?

Being self-employed shouldn’t change the mortgage options open to you, but it’ll mean you need to provide slightly different information, which can make the mortgage application process a little more complex. Add in bad credit and things start to get even more difficult now that you’re ticking 2 niche boxes. If you add in any further complexities, like a shared ownership scheme then you’ll find the number of products available to you even more limited.

This doesn’t mean you won’t be approved for a mortgage, but it does mean that you’ll need a lender who specialises in bad credit and is more flexible and open to more nuanced financial circumstances, like being self-employed.

In these circumstances, it’s best to get expert advice and support from an experienced bad credit mortgage broker. Bad credit mortgage brokers are used to helping people with diverse credit issues, understand what different specialist lenders can offer and who they’re likely to accept. They can also suggest ways to strengthen your application and have access to the whole mortgage market, including special deals and rates that you wouldn’t otherwise have access to.

Specialist lenders often only work through intermediary brokers, like John Charcol. This means going through a broker is also the best way of making sure you’re getting access to the most suitable lenders and the best value deals on the market that take account of your employment status, financial circumstances and mortgage needs.

It’s also wise to engage with your broker before you start applying for mortgages with bad credit. If you approach the wrong lender directly and are declined, you could end up negatively affecting your credit profile even more, with a hard credit check appearing on your record. A bad credit mortgage broker will know the market well, understand the eligibility criteria of different lenders and be able to help identify the best lender before you start applying.

What Criteria Will I Need to Meet to Get a Self-Employed Bad Credit Mortgage?

Some people feel a bit nervous about the assessment for a bad credit mortgage, but there’s nothing to worry about. The difference with a bad credit mortgage is that the assessment will usually be a manual one that takes a holistic view of your personal situation, rather than a standard, automated one that focuses on your credit profile.

This tends to make the assessment a bit longer and more detailed, but it also gives a fairer and more rounded view of your finances and is more likely to result in a mortgage approval.

Bad credit lenders will assess your eligibility for a mortgage on an individual case-by-case basis, but will generally look at the same criteria when approving a mortgage application, including:

- Proof of income - as a self-employed person, your income will be assessed slightly differently from an employed individual. For example, typically lenders will ask to see your accounts or tax calculations for the last one to three years. Fluctuations in earnings can raise concerns, so ideally, you’d be able to demonstrate a steady income over the time period

- Proof of outgoings - lenders will want to know you’re not over-stretching yourself and will typically look at bank statements and other debts or outgoings you have to make sure you can afford the loan

- The reason for bad credit - it can help reassure lenders if they understand the reason for the bad credit event, such as a one-off health issue or a divorce that caused a particular financial issue that’s not likely to happen again

- Evidence the bad credit issue is being resolved - if you can demonstrate you’ve taken, or are taking, positive steps to resolve your adverse credit issue, this will look better to the lender

Can I Remortgage If I’m Self-Employed with Bad Credit?

It’s always worth remembering, that whatever your employment status, once your fixed mortgage comes to an end, you’ll have to apply to remortgage your property and go through the same credit check process.

If you have bad credit, this doesn’t mean you won’t be able to remortgage, but adverse credit events will show up on your credit profile and some high street lenders might automatically reject your remortgage application.

As with applying for a mortgage with poor credit, remortgaging with bad credit will likely mean you have more limited options and will need to remortgage with an adverse credit lender. Although in this case, you hopefully have the advantage of evidencing that you’ve made all your previous mortgage payments to strengthen your position and achieve better mortgage rates. In some circumstances, it might be worth considering a product transfer instead – your broker will be able to advise you on this.

Mortgage brokers can also help if you’re thinking about remortgaging to pay off or consolidate debts. This is a different situation as it involves raising capital, so it’s a good idea to get expert advice from a broker to make sure you’re choosing the best option to suit your financial needs. To get in touch, enquire online or call us on 0330 433 2927.

First-Time Buyer Mortgages

Discover the best first time buyer mortgage rates available and the latest advice from John Charcol: mortgage broker for first time buyers.

Applying for a Mortgage

Applying for a mortgage couldn’t be simpler with our easy and simple guide from application to accepting your offer.

How Much Can I Borrow?

This mortgage calculator examines your income and works out how much money a mortgage lender might provide you with

House Buying Mortgage Guide

Are you looking to buy your first home? Or perhaps want to move to a new area? Our step-by-step guide will tell you everything you need to know about buying a house.

Help to Buy Guide

Support from the government-backed Help to Buy initiative is available for first-time buyers and existing homeowners who are finding it difficult to move up the housing ladder.

House Mortgage Deposit

Saving a mortgage deposit for a house is definitely one of the biggest hurdles you face as a buyer. In our guide we explain how deposits work and ways you can save.

Mortgage Deposit Amounts

Learn all about the different mortgage deposit amount options, how they affect your mortgage, how they vary depending on what type of borrower you are & more.

Funding Home Improvements

There are a few ways to finance work on a house: get a home improvement loan, remortgage for home improvements, ask your lender for a further advance & more

Mortgage Glossary

On this page you’ll find our detailed mortgage terminology glossary. There’s a lot of jargon out there but we’re here to make it easy.