If you're thinking about entering into an IVA (individual voluntary agreement), it's important to understand how it will affect your credit situation. IVAs can be a helpful way to manage debt problems that are out of control. But just like any adverse credit, it can negatively impact your credit report.

Your credit score will be lower and you'll find it much harder to get any type of credit - including mobile phone contracts, loans and mortgages. But that's not to say it's impossible. Here, we'll look at IVAs in more detail and how they can affect your credit score during an IVA and afterwards.

The Topics Covered in this Article Are Listed Below:

- What's an IVA?

- What's a Credit Score?

- Does an IVA Affect My Credit Score?

- How Long Does an IVA Affect Your Credit Score?

- Can I Remove an IVA from My Credit Report?

- Will My IVA Affect My Partner's Credit Score?

- Will My IVA Damage the Credit Score of the People I Live With?

- Will My Credit Score Go Up After an IVA?

- How to Improve Your Credit Score After an IVA

- Can I Get Credit While In an IVA?

- Can I Get a Mortgage with an IVA?

- Do I Need to Disclose My IVA on a Mortgage Application?

- How Do IVAs Affect Mortgages?

- Can I Remortgage with an IVA?

- Summary: Does an IVA Affect Your Credit Score?

What's an IVA?

An IVA is a legal agreement between you and the companies you owe money to and is a way for you to settle bad credit. It allows you to repay your debts over an agreed period, usually around 5 - 6 years.

How much debt you can write off will depend on your situation. If you can afford to, you may be required to release any equity you have in your home. Your IVA will be arranged by an insolvency practitioner who's a legal professional and will agree to a payment plan with your creditors which considers your circumstances and how much you can afford to repay.

IVAs can be used to repay debts from:

- Credit cards and store cards

- Personal loans

- HMRC

- Bank overdrafts

- Council Tax arrears

- Hire purchase debts.

Entering into an IVA can stop your debts from spiralling due to interest and provides a clear timeline for when you'll repay the debt. Your debts will be frozen, and no further interest will accumulate. An IVA can allow you to keep your home and help avoid further action from your creditors against you, including forcing you into bankruptcy. When the IVA finishes, you'll no longer have financial commitments to your creditors. Your IVA will show on your credit report and lower your credit score.

What's a Credit Score?

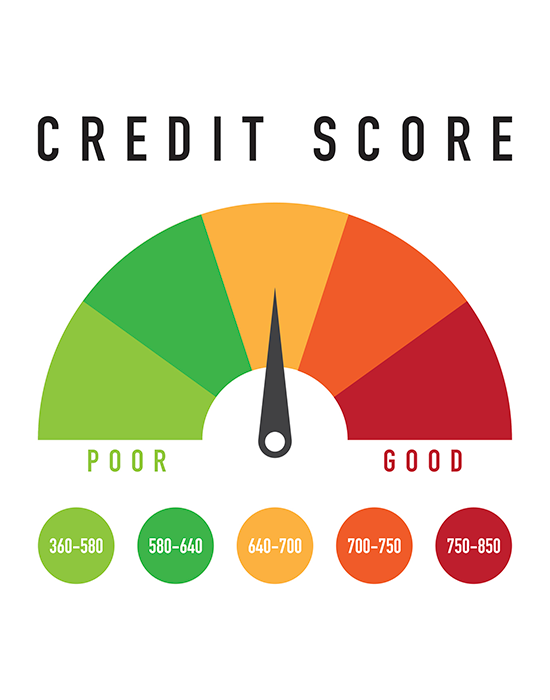

A credit score is a 3 digit number that reflects how responsible you are at borrowing and repaying money. Lenders will check your credit score whenever you apply for credit before deciding whether to lend to you. A good credit score can help you get approved for various credit facilities, including overdrafts, credit cards, loans and mortgages. A poor credit score can mean you’ll struggle to get approved for credit, or you'll likely be offered higher interest rates if you are.

Credit scores typically range from very poor to excellent. The 3 main UK credit reference agencies, TransUnion, Equifax and Experian, hold data about your financial history in a credit report which is used to generate your credit score.

Each lender and credit reference agency has their own system they use to calculate your credit score based on your credit report. If you've always paid bills on time and used credit responsibility, this will positively impact your score. However, if you have a history of late, missed, or default payments, it will inevitably have a negative impact. If you've never had credit before, your lenders will struggle to assess your borrowing risk, which is reflected in your credit score.

Does an IVA Affect My Credit Score?

An IVA will negatively impact your credit score. You must make your repayments on time and in full, as defaulting on your IVA will only cause your credit score to drop even more. When you've had an IVA, creditors will consider you as high risk as they'll know you've struggled to repay your debts and have probably been unable to manage your finances responsibly. To be in a good position to get credit in the future, you need your credit score to be as high as possible, as this shows you have a good history of money management.

How Long Does an IVA Affect Your Credit Score?

Your IVA will remain on your credit report for 6 years from its approval date, but the longer it’s been since the IVA was completed, the less of an impact it will continue to have on your credit score.

Once you've settled the debt and it's all clear, the IVA will be marked as complete on your report, but will still be visible to potential lenders for 6 years. If you have any debts not included in your IVA, they'll be listed separately. Some lenders may ask you to confirm whether you've ever had an IVA even if it’s been longer than 6 years since yours was completed.

Can I Remove an IVA from My Credit Report?

IVAs are automatically added, marked as settled and removed from your credit report after 6 years. If you spot any inaccuracies on your credit report, contact the credit reference agency, provide them with a letter from your insolvency practitioner, and the agency should update it. You can also ask for an explanatory note to be added to your credit report that explains what led you to get into debt and require an IVA. For instance, you may have had a long term illness or were made redundant.

Will My IVA Affect My Partner's Credit Score?

Entering an IVA will not damage your partner's credit score. However, the exception is if you share finances with them, such as a joint bank account or a credit agreement under both your names. The IVA – even if it’s for a debt that’s solely your own - will damage your credit score and this poor credit score could then impact your partner’s credit score. To avoid any financial associations affecting your partner's credit rating, you should close joint accounts and remove your name from all shared financial agreements before starting your IVA.

It’s important to point out that your bad credit will impact the joint mortgage options available to you and your partner.

Will My IVA Damage the Credit Score of the People I Live With?

Your address is not associated with your financial position, so your IVA won't affect anyone you live with, including their credit score. But it's still a good idea to ensure that you have no financial links with the people you live with, as these could be considered a financial association. Be sure to sever all financial ties with everyone at your address if they aren't directly involved in your financial situation if you have an IVA. This means avoiding opening a joint bank account with your housemates for paying bills, as this could adversely affect everyone on the account. However, don't worry if you are named alongside others on your utility bills or tenancy agreement, as this shouldn't be a problem.

Will My Credit Score Go Up After an IVA?

The good news is that after your IVA ends, you should start to see an improvement in your credit score. Once you've made your last payment and your IVA is completed, your insolvency practitioner will give you a certificate of completion and inform your creditors. The Insolvency Service will also be notified and remove your details from the Insolvency Register. You'll need to update credit reference agencies to let them know your IVA has been completed. Your credit score after an IVA should steadily improve. Essentially, the more time has passed since your IVA, the less of an impact it will have on your credit score. As soon as your IVA is marked as complete, your credit report will immediately start to look better, and after 6 years, the IVA will be removed from your credit report.

How to Improve Your Credit Score After an IVA

There are plenty of ways you can gradually rebuild your credit rating after and IVA including the below.

Regularly Check Your Credit Report

You should regularly check your credit report with the 3 main agencies – Equifax, TransUnion and Experian – to keep an eye on whether there's anything new or any inaccuracies. Sometimes there can be errors on a credit report, but you can contact the creditor and get them to put it right. You should also look for any mistakes with your basic personal information to ensure it's all up to date.

Get on the Electoral Roll

Registering to vote makes it easier for lenders to prove your identity, as you'll need to provide your address. You can check whether you're already on the electoral register and register if you're not.

Reduce Your Credit Use

One way to make your credit report look as good as possible is to use credit responsibly. Ensure you're not maxing out all your credit cards.

Don't Apply for Lots of Credit at Once

You must avoid making lots of applications for credit in a short timeframe. Each time you apply for credit, a hard credit search will be conducted on your credit file, which is recorded on your credit report for 12 months.

Check for Any Financial Links with Other People

Your credit report will show you if there's anyone you share accounts with. Having financial associations with anyone with bad credit could also decrease your score.

Check that Your Name Is on the Household Bills

If you pay one or more household bills, make sure your name is on them, otherwise, it won't benefit your credit score. If you pay bills on time, it's good financial behaviour that can be recorded on your credit report to help improve your credit score.

Can I Get Credit While In an IVA?

Whenever you apply for credit, creditors will check your credit report and will be able to see that you're in an IVA. But while getting credit while you're still in an IVA is not impossible, it's not easy. Lenders will want to see how you manage your money after your IVA. If you've made all your repayments on time and in full and have not had any other credit issues, some creditors may be willing to consider you, depending on how much you want to borrow and where you are in your IVA journey.

It's common for IVAs to have a clause in the agreement that says you cannot get credit over £500 during your IVA without consent from your IVA supervisor. If you decide to get credit without your IVA supervisor's approval, you'll have breached your IVA's terms and conditions, which could lead to it failing. You may be able to get permission to get credit in some circumstances, such as to remortgage if your fixed rate term is coming to an end. However, your supervisor will want to ensure that this credit won't negatively impact your IVA and your capacity to make your agreed IVA monthly payments.

Can I Get a Mortgage with an IVA?

Getting a mortgage when you have an IVA is possible, but it will be much more challenging as you'll have a very low credit score. Most mortgage lenders will take your IVA to mean that you've had severe credit issues and cannot manage your money effectively. Some of the larger banks won't consider lending to you with an IVA, however, a few specialist, adverse credit mortgage lenders will.

Specialist lenders who offer bad credit mortgages will take a wider look at your finances and circumstances, including your current situation and ability to meet your repayments. However, these lenders will charge higher rates, offer less favourable terms and may want to see that you've had at least 2 years of good credit after your IVA before considering your application. Therefore, you should carefully consider any credit applications after your IVA. Getting declined will hurt your credit score. That's why you mustn't apply for too much credit at once. Instead, focus on the lenders more likely to accept you.

If you want a mortgage with a bad credit history, it's a good idea to work with an independent specialist mortgage broker like John Charcol. We have access to the whole market and will use our expertise to help you find the right specialist lender for your circumstances.

Do I Need to Disclose My IVA on a Mortgage Application?

It's always best with any credit application, especially a mortgage, to be as honest as possible and declare your IVA. Even if the IVA has come off your credit file when you apply for a mortgage, most lenders will want to know if you've had any earlier credit issues. Being upfront will save you time and money in the long run. If you fail to let your lender know and they find out, you could be refused a mortgage, even after paying fees.

How Do IVAs Affect Mortgages?

Once you've had an IVA, you'll likely find that the pool of mortgage lenders and products you can access is smaller. Lenders will likely require you to pay a higher interest rate or put down a larger deposit to lower the risk to the lender.

The longer it’s been since your IVA, the more lenders and the better the deals available to you.

Can I Remortgage with an IVA?

While you are in an IVA, there will be certain restrictions on your home, which will be outlined in your agreement. Check the terms of your agreement to see what specific restrictions it has on your property. Normally, you cannot remortgage while in an IVA. When you have 6 months left of your IVA, your insolvency practitioner will send you the terms of your agreement to review. They'll also ask your mortgage lender to provide a statement of how much is left on your mortgage and will conduct a property valuation.

Pay Off IVA with Debt Consolidation Mortgage

You may consider your options for remortgaging early as a way to consolidate your debt and pay off your IVA, but this isn’t usually advised. The rates you would likely have access to would be extortionate so consolidating wouldn’t be worthwhile. It’s best to pay off your IVA and work on improving your score if you can before applying for a mortgage.

Summary: Does an IVA Affect Your Credit Score?

An IVA is a severe form of bad credit that can have serious implications for your credit score and hinder your ability to get any form of credit, from a mobile phone contract to a mortgage, for several years. However, when an IVA is managed well, it can help stop your debt from spiralling and enable you to get your finances back on track.

If you're in an IVA or have completed one and are looking for a mortgage, we recommend you speak to a reputable independent specialist mortgage broker like John Charcol. We'll use our extensive market knowledge to find the right lender and mortgage product for your circumstances. Get in touch with us today on 0330 433 2927 to learn more about how we can help.

First-Time Buyer Mortgages

Discover the best first time buyer mortgage rates available and the latest advice from John Charcol: mortgage broker for first time buyers.

Applying for a Mortgage

Applying for a mortgage couldn’t be simpler with our easy and simple guide from application to accepting your offer.

How Much Can I Borrow?

This mortgage calculator examines your income and works out how much money a mortgage lender might provide you with

House Buying Mortgage Guide

Are you looking to buy your first home? Or perhaps want to move to a new area? Our step-by-step guide will tell you everything you need to know about buying a house.

Help to Buy Guide

Support from the government-backed Help to Buy initiative is available for first-time buyers and existing homeowners who are finding it difficult to move up the housing ladder.

House Mortgage Deposit

Saving a mortgage deposit for a house is definitely one of the biggest hurdles you face as a buyer. In our guide we explain how deposits work and ways you can save.

Mortgage Deposit Amounts

Learn all about the different mortgage deposit amount options, how they affect your mortgage, how they vary depending on what type of borrower you are & more.

Funding Home Improvements

There are a few ways to finance work on a house: get a home improvement loan, remortgage for home improvements, ask your lender for a further advance & more

Mortgage Glossary

On this page you’ll find our detailed mortgage terminology glossary. There’s a lot of jargon out there but we’re here to make it easy.