Can You Afford a Baby if You’re Self-Employed?

Written on 16 January 2019 by

Maternity pay is always a hot topic, but what happens if you’re self-employed? Recently, John Charcol carried out a survey to discover what mothers really think about self-employed maternity pay and whether having a baby whilst self-employed is affordable.

Are You Entitled to Maternity Pay if You’re Self-Employed?

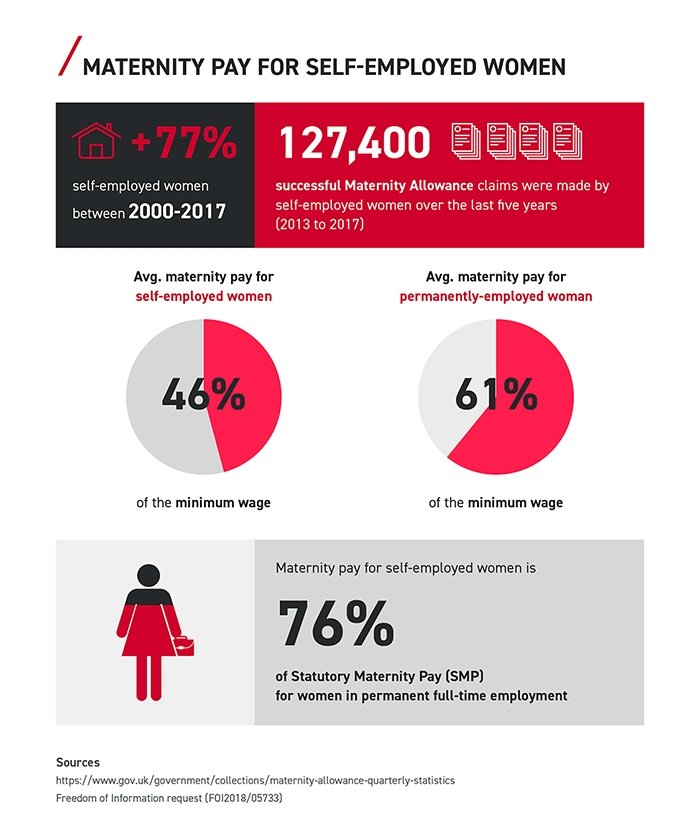

Self-employed women don’t receive Statutory Maternity Pay (SMP), which is what women in full-time employment receive. Instead, self-employed women receive what’s known as Maternity Allowance. Maternity Allowance is only 76% of what you’d receive in SMP. It’s also under half of minimum wage.

How It Works

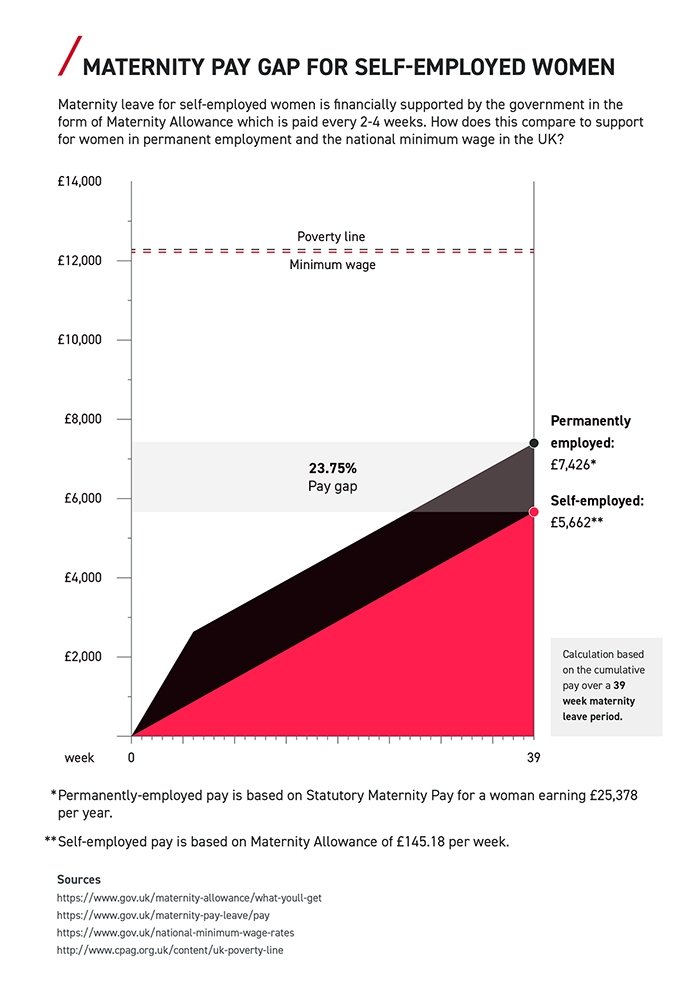

As a self-employed mummy, you receive Maternity Allowance every 2 or 4 weeks for up to 39 weeks. The maximum you can receive is the equivalent of £145.18 per week. If you earn under a certain amount already, you’ll receive 90% of your earnings for 39 weeks – whichever is less.

Now, 90% of your salary doesn’t sound too bad, but this is only for those who earn well under minimum wage. The £145.18 limit only equivalates to £7549.36 a year! Obviously, you would receive it for 39 weeks not 52, but you see where we’re going here. . .

Is this really enough? John Charcol recently found that 69% of mothers believe Maternity Allowance should be higher for self-employed women.

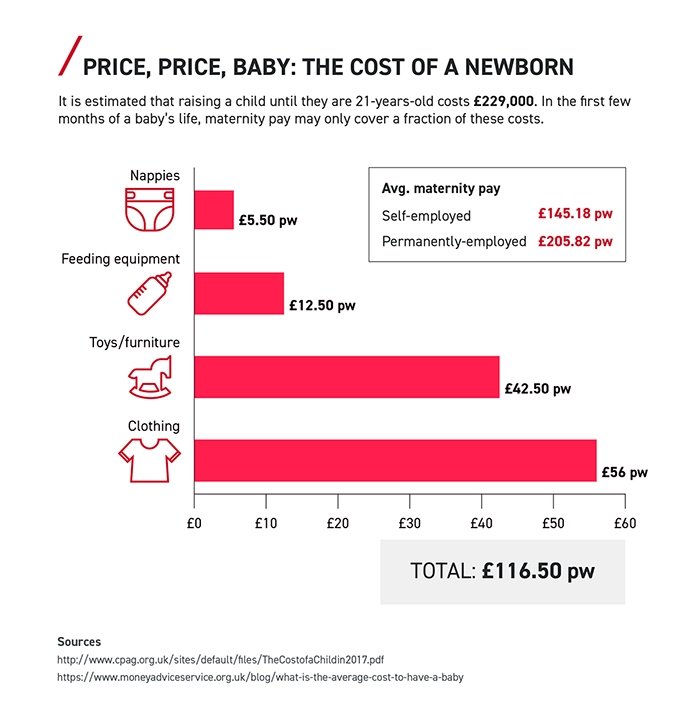

This isn’t surprising when you consider the staggering price of a newborn.

At £116.50 per week, a newborn baby will both literally and figuratively eat your Maternity Allowance, leaving little for other living expenses! Your usual outgoings won’t suddenly vanish. You’ll still have rent or your mortgage payments, monthly bills, food, car insurance, etc.

It’s a little better for full-time mums at £202.82 per week, but this is still well below the poverty line.

Your outgoings increase drastically after you have a baby, while your income is cut to the lowest it’s maybe ever been. Being self-employed doesn’t really change how much a baby costs, yet you’re expected to live on almost a quarter less maternity pay than your employed counterparts.

Receiving Maternity Allowance can also impact how much you receive in other benefits.

The Partner Assumption

The fact that you receive far less than minimum wage in Maternity Allowance means that the onus will fall on your partner and their salary. But, what if you’re self-employed as well as the one who earns more money?

Unlike full-time employed women, the self-employed can’t split their parental leave with their partners. Our survey revealed that 83% of mothers believe this is unfair, which is understandable, as it means that a self-employed woman who usually earns more than her partner will likely find it harder to return to work early than an employed woman – despite the fact that:

- A self-employed woman receives less in maternity pay

- 85% of self-employed mothers feel pressure to return to work early from maternity leave – according to John Charcol’s 2018 survey

And what about those women who are single and self-employed? In these circumstances, you don’t have another salary to rely on and you have a newborn baby to care for. Is returning to work your best option?

Going Back to Work Early

Some women want to return to work early after having a baby – and you should have that option. But, is it right that such a majority of self-employed mothers feel pressured into doing so? The NHS found that many women who return to work early from maternity leave suffer from increased levels of stress, anxiety, sleep deprivation and an overall lack in confidence.

Self-Employment is Growing: Has the Maternity Allowance Grown with It?

The Office for National Statistics found that the self-employed made up 15.1% of the UK labour force in 2017 – a total of 4.8 million people. What’s more, the number of women opting for self-employment is constantly rising: between 2000-2017 the number of self-employed women in the UK increased by 77%.

The Maternity Allowance was first introduced in 1948. It’s grown a lot since then. Originally it was only 13 weeks, but now matches the SMP at 39 weeks. The maximum rate of Maternity Allowance has risen almost yearly during the last 15 years. It was £100 in 2003 and has risen by just over 45%, now standing at £145.18 (April 2018-2019).

Recent years have clearly seen some fantastic changes, but it is enough or was it just really dire all those years ago?

There could be alterations in the way it’s designated. Perhaps the amount available to you could vary depending on whether you have another household salary contributing towards your expenses or whether you have savings to lean on? Loans and grants work in this way, is it unrealistic to assume Maternity Allowance should too?

However, even if further changes were made – is it the government’s responsibility?

What You Can Do

You can:

- Find out your entitled Maternity Allowance, then write a weekly budget for you and your new baby. You can see how this compares with what your household earnings would be on your entitled Maternity Allowance

- Speak to friends and family about any good quality, second-hand baby furniture or toys they don’t need anymore

- Save as much as you can! Be harsh about the expenses you could live without

Pregnancy and the birth of your baby are supposed to be magical, albeit intimidating, times for parents. Unfortunately, they’re easily overshadowed by the almost insurmountable expenses. So, although it’s important that you figure out whether having a baby while self-employed would be affordable for you, it’s also important that you lucky parents to-be remind yourselves of all the good stuff you’ve got to look forward to!

For more information about your mortgage options as a self-employed mother take a look at our self-employed mortgage page.

Categories:Self-Employed Mortgage Advice, Robyn Clark

The blog postings on this site solely reflect the personal views of the authors and do not necessarily represent the views, positions, strategies or opinions of John Charcol. All comments are made in good faith, and John Charcol will not accept liability for them.