Bank Holiday opening hours on Monday 6th May are 9 am – 1pm

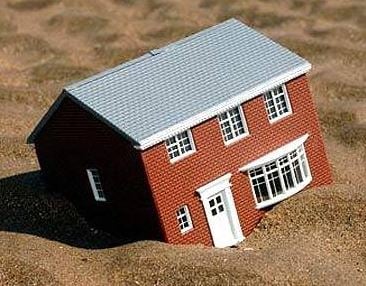

If you discover that the house you’re looking to buy has subsidence, you may be having second thoughts about the purchase. After all, can you get a mortgage on a property with subsidence? Subsidence can be a scary word when you’re buying a home as it can hugely affect a property's structural safety and value. But it doesn't always have to mean saying goodbye to the house that finally feels right for you.

While subsidence affects around 20% of homes in England and Wales, the good news is that there are mortgage options available for this type of situation. This guide will look at subsidence and mortgage lending and what subsidence could mean for you as a house buyer, homeowner and future seller.

The Topics Covered in this Article Are Listed Below:

- What Is Subsidence?

- Which Properties Are More Likely to Be Affected by Subsidence?

- What Factors Increase a Property's Risk of Subsidence?

- What Are the First Signs of Subsidence?

- Can I Get a Mortgage on a House with Subsidence?

- Does My Home Insurance Cover Subsidence?

- How Can Subsidence Be Rectified?

- What Is Underpinning?

- What About Minor Subsidence?

- Buying a House with Subsidence

- Does Subsidence Affect the Value of a Property?

- Can I Remortgage with Subsidence?

- Should I Buy a House with a History of Subsidence?

- Can I Sell a House with a History of Subsidence?

- Speak to a Mortgage Expert

What Is Subsidence?

Subsidence is the sudden sinking of the ground that a property is sitting on. It can occur naturally or be caused by human activities. All properties experience a little movement, which often goes unnoticed. Sometimes it can be a downward movement and cause the building to become unstable. Subsidence can affect both a property's structural safety and market value.

Subsidence is different from settlement, which typically happens with new build properties when the ground compacts beneath the weight of the new building. However, subsidence is not caused by the building's weight, but by the ground underneath it becoming increasingly unstable.

Which Properties Are More Likely to Be Affected by Subsidence?

Any type of property can have subsidence, whether it's an old or relatively new property. However, homes that are built on particular types of soil are at greater risk of being affected by subsidence. Properties on clay soil, frequently found in the South East of England, are especially vulnerable.

Clay soil can expand in wet weather and then contract when it's dry, causing the ground to subside. Also, properties that are built on silt, gravel or sand, such as those near rivers or the coast, can be susceptible to subsidence and erosion. Properties that were built in ex-mining areas in the UK, such as the North West of England, Yorkshire and the Midlands, are also more vulnerable to subsidence problems.

In some instances, your home may also be subject to non-standard construction, so you may need to discuss Non-Standard Construction mortgages with your broker.

What Factors Increase a Property's Risk of Subsidence?

When looking at potential properties to purchase, there are several things to look out for that could indicate a property has a greater risk of subsidence.

Clay Soil

Many subsidence problems involve clay soil which is prone to shrinking, cracking and moving during dry, warm weather which can unsettle property foundations, leading to subsidence. Check neighbouring properties to see if they have any external cracks to indicate whether there's clay soil in the vicinity.

Large Trees Near the Property

The presence of large trees close to a property can cause stability problems with the home's foundations. Thirsty plants can dry out the ground, while large tree roots can disturb the soil underneath foundations making it more susceptible to movement and cracks.

History of Local Mining

If there's a history of mining in the area, there's a greater risk of subsidence. Find out what historic mining activity there is in the area as part of your pre-purchase property searches so you're aware of potential risks.

Old Foundations

Older properties have foundations which are often shallower and more vulnerable to erosion and subsidence.

Water Leaks

If there are damaged household drains or water mains in the vicinity, or previous cases of flooding over time, this can increase the risk of subsidence. Soil that has become extremely wet can quickly become unstable and wear away under a property's weight.

What Are the First Signs of Subsidence?

The first tell-tale signs of subsidence are torn areas of wallpaper and doors and windows that have started to stick. You may also see cracks in the walls that appear in the same area both outside and inside the house. These cracks usually appear diagonally near windows and tend to be wider at the bottom than the top and thicker than 3mm. As the ground beneath your home becomes increasingly unstable and moves downwards, it will also take some of your home's foundations down. With one part of the building starting to move, it puts pressure on the property's structure, causing cracks to appear at the points of tension.

It's important to keep in mind that not all cracks mean there's subsidence. Small hairline cracks in the wall are normal and happen due to materials expanding and contracting, caused by changing temperatures.

Can I Get a Mortgage on a House with Subsidence?

It’s unlikely you’ll get a mortgage on a house that currently has subsidence as it can cause serious structural damage that could potentially:

- Make the property uninhabitable

- Require extensive and expensive repairs

- Cause the property to collapse

Part of a standard lender's mortgage conditions is that a property must qualify for building insurance. However, most insurers will refuse to insure a property known to have subsidence.

If subsidence has previously been picked up and dealt with, then you should be able to get a mortgage on the property. The lender will instruct a surveyor to check that the problem has been resolved as part of your mortgage application.

If the property you want to buy currently has a severe subsidence problem, you would need to get a bridging loan to purchase the property and rectify subsidence before getting a mortgage on it. A bridging loan would enable you to get some specialist buildings insurance on the property until the remedial work is done and you remortgage and switch insurance providers.

Alternatively, some lenders may agree to approve a mortgage on the property but will only release the full funds once you've completed the remedial works. For example, the lender gives you 6 months to carry out the work and then the valuer will revisit the property to verify the work has been completed.

If you want to buy a property with subsidence, you should speak to an independent mortgage adviser at John Charcol to see what mortgage options are available.

Does My Home Insurance Cover Subsidence?

Most traditional buildings or home insurance policies don't cover existing subsidence issues. If you purchase a house which later develops subsidence, your home insurance should cover at least some of the cost of repairing the damage. It won't cover the actual cost of fixing the subsidence problem itself.

How Can Subsidence Be Rectified?

Whether you’re buying your first home or an experienced homeowner moving to a new property, subsidence can be a huge worry. But it is possible to fix subsidence and stop it from returning. Underpinning is one of the most common ways to deal with subsidence, strengthen a property's foundations and minimise the impact of subsidence on your home. Once this work is finished, you'll be issued a Certificate of Structural Adequacy (CSA), confirming the work to rectify subsidence is completed. This will then be followed by a monitoring period. Many lenders will require you to provide a CSA when considering your mortgage application. You will also probably want to instruct a full structural survey on the property to check for any other potential structural defects.

What Is Underpinning?

Underpinning is an effective technique to strengthen a property's foundations severely affected by subsidence. It can offer reassurances that any previous problems with subsidence have been dealt with. The cost of underpinning a house will depend on how severe the subsidence problem is and the type of underpinning process used.

- Jet grouting: this strengthens weak soil under a property's foundations by creating a strong base using high-pressure jets to mix the existing soil with a self-hardening grout

- Mass concrete underpinning: this process uses concrete to deepen or extend the existing foundations and is the most common type of underpinning

- Piling: by driving piles into the ground to sit on more stable soil, this method is considered the most versatile way to strengthen the foundations of a property

What About Minor Subsidence?

Minor subsidence caused by leaking water pipes or tree roots are reasonably easy to fix and, as a result, shouldn't cause too many problems when looking to get a mortgage, as long as all the repairs are completed. Major subsidence issues, like shifting soil, may require more extensive remedial works such as underpinning. In this case, it could mean your lender rejects your application. Whatever the degree of subsidence, it's always a good idea to get advice from a structural engineer following the surveyor's completed valuation.

Buying a House with Subsidence

You may be tempted to buy a house with a history of subsidence, as it could give you a better chance at negotiating a reduced price. But it also means that you may find fewer lenders prepared to lend to you, you may have to pay more in home insurance and it could mean extensive repair costs now or down the line.

Structural Survey

You should also organise a comprehensive structural survey on the property before proceeding with the purchase. If subsidence is a current issue, a full structural survey will assess the severity of the problem and advise on what work is required to deal with it.

Conveyancer Checks

If repairs have previously been completed for subsidence, your conveyancing solicitor can get the appropriate legal documents from the seller to check that the repairs were completed by a professional to the required standards. If the property was underpinned, the documentation should include a Completion Certificate. There should also be a Certificate of Structural Adequacy if the repairs were carried out for an insurance claim.

Insurance Checks

Through your conveyancer, you can determine who the property is insured with and for how much. You can then check your options, which may be limited, and you may find policies to be expensive.

Does Subsidence Affect the Value of a Property?

How much subsidence affects the value of the property will depend on the severity of the problem and how recent it is. Even a property that has been underpinned to deal with subsidence can be worth less, dropping by as much as 20% in market value compared to similar properties without a history of subsidence.

Can I Remortgage with Subsidence?

If you own a property that you want to remortgage with a new provider, but the house has subsidence, you will be treated the same as someone considering buying a new property with subsidence. Most lenders will not want to take on your property until the issue is dealt with. This means that, in most cases, you'll have to rectify the subsidence problem before approaching lenders. Alternatively, you could stay with your existing lender, but most will still want you to carry out the work before letting you do so.

Should I Buy a House with a History of Subsidence?

Buying a property with a history of subsidence is not a good idea if you don't know the full extent of it, what needs to be done to fix it and how much it will cost. However, properties with subsidence tend to sell for much less than their market value and subsidence isn't always a huge expense to fix, depending on its severity, so you could potentially get a good deal. Once the subsidence has been repaired, it is both mortgageable and worth the full market value. Therefore, buying a home with subsidence could be a worthwhile and profitable investment in the right circumstances.

Questions to Ask Before Buying a House with Subsidence

If you discover that the house you’re looking to buy either has subsidence or a history of subsidence, there are some important questions you need to ask before progressing with the purchase.

- How severe is the subsidence? Don't just take the seller's word on this — get expert advice

- What work is required to rectify the subsidence? You need to take professional advice from a surveyor on what is the best way to fix the problem

- How much will it cost to rectify the subsidence and repair the damage it caused? Compare several quotes

- Will the combined cost of purchasing the property, fixing the subsidence and repairing the damage be significantly less than purchasing a similar but subsidence-free property?

- Will you be able to get a lending on the property to pay for the work – e.g. bridging

- Can you get home insurance for the property once the subsidence is sorted?

- Will you be able to easily sell the property in the future once the subsidence issue is fixed?

Can I Sell a House with a History of Subsidence?

If your home has had subsidence that has been successfully dealt with, you must keep all relevant paperwork and make it available to prospective buyers. A history of subsidence could potentially make getting insurance and a mortgage more challenging, which will put some buyers off. You'll need to explain to prospective property buyers that the situation has been dealt with and that it's no longer an issue while answering all their questions honestly.

If the subsidence occurred while you owned the property, be sure to be as forthcoming as possible about the causes of the problem and how it was dealt with. Unfortunately, just hearing the word "subsidence" is enough to put off some prospective buyers, even if the problem has been successfully rectified. It is best to be upfront about any historic subsidence and how and when it was resolved, as it will show up in a property survey.

Speak to a Mortgage Expert

Contact our independent mortgage experts if you want to purchase a property with subsidence or have questions about getting a mortgage on a property with known or historic subsidence.

At John Charcol, we have access to a broad range of mortgages, including exclusive deals and specialist lenders. We can help you find the right product for your circumstances. Get in touch with us today on 0330 433 2927 or submit an online enquiry to find out more.

First-Time Buyer Mortgages

If you’re thinking of buying your first home, discover the latest advice and the best first-time buyer mortgage rates available on the market with John Charcol today.

Applying for a Mortgage

Applying for a mortgage couldn’t be simpler with our easy and simple guide from application to accepting your offer.

How Much Can I Borrow?

This mortgage calculator examines your income and works out how much money a mortgage lender might provide you with

House Buying Mortgage Guide

Are you looking to buy your first home? Or perhaps want to move to a new area? Our step-by-step guide will tell you everything you need to know about buying a house.

Help to Buy Guide

Support from the government-backed Help to Buy initiative is available for first-time buyers and existing homeowners who are finding it difficult to move up the housing ladder.

House Mortgage Deposit

Saving a mortgage deposit for a house is definitely one of the biggest hurdles you face as a buyer. In our guide we explain how deposits work and ways you can save.

Mortgage Deposit Amounts

Learn all about the different mortgage deposit amount options, how they affect your mortgage, how they vary depending on what type of borrower you are & more.

Funding Home Improvements

There are a few ways to finance work on a house: get a home improvement loan, remortgage for home improvements, ask your lender for a further advance & more

Mortgage Glossary

On this page you’ll find our detailed mortgage terminology glossary. There’s a lot of jargon out there but we’re here to make it easy.